22+ montana paycheck calculator

Your average tax rate is 1198 and your marginal tax rate is. Montana Montana Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

Montana Paycheck Calculator Smartasset

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

. Montana Montana Salary Paycheck Calculator Change state Calculate your Montana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Enter your info to see your take home pay. Payroll pay salary pay check.

Montana Income Tax Calculator 2021. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Montana Paycheck Calculator Use ADPs Montana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Montana Salary Calculator for 2022 The Montana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and. Ad Compare 5 Best Payroll Services Find the Best Rates. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Montana.

As an employer in Montana you have to pay unemployment compensation to the state. Well do the math for youall you need to do is enter. Supports hourly salary income and multiple pay frequencies.

Just enter the wages tax withholdings and. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Montana. Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator.

The 2022 rates range from 1 to 675 on the first 35300 in wages paid to each. Figure out your filing status work out your adjusted gross income. Back to Payroll Calculator Menu 2013 Montana Paycheck Calculator - Montana Payroll Calculators - Use as often as you need its free.

The state income tax rate in Montana is progressive and ranges from 1 to 675 while federal income tax rates range from 10 to 37 depending on your income. If you make 70000 a year living in the region of Montana USA you will be taxed 12710. Simply enter their federal and state W-4 information as.

Make Your Payroll Effortless and Focus on What really Matters. Net income Payroll tax rate Payroll tax liability Step 6 Minus everything Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every.

Paycheck Calculator Us Apps On Google Play

Uv Reading Glasses Blue Light Glasses Computer Reading Glasses Eye Strain Clear Anti Uv Filter Protection Men Women Uv Blocking Glasses Amazon Co Uk Health Personal Care

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Ibuyer Reviews Rankings Pros Cons And Alternatives

Montana Paycheck Calculator Tax Year 2022

Montana Income Tax Calculator Smartasset

Personal Financial Planning For Divorce Fpa Ma November 19 Ppt Download

Jolie Guerrier Tumblr Blog Tumpik

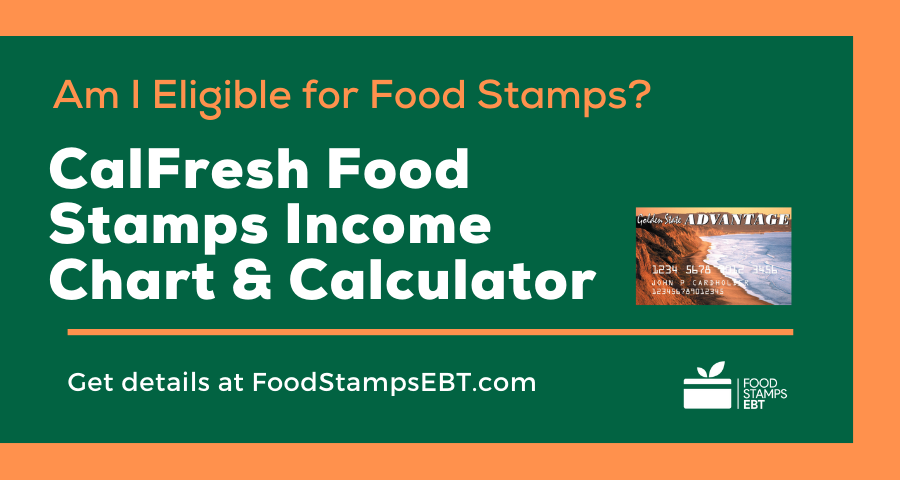

California Food Stamps Eligibility Guide Food Stamps Ebt

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Montana Paycheck Calculator Adp

Pdf 2015 Risp Web 2 Pdf Sheryl A Larson Academia Edu

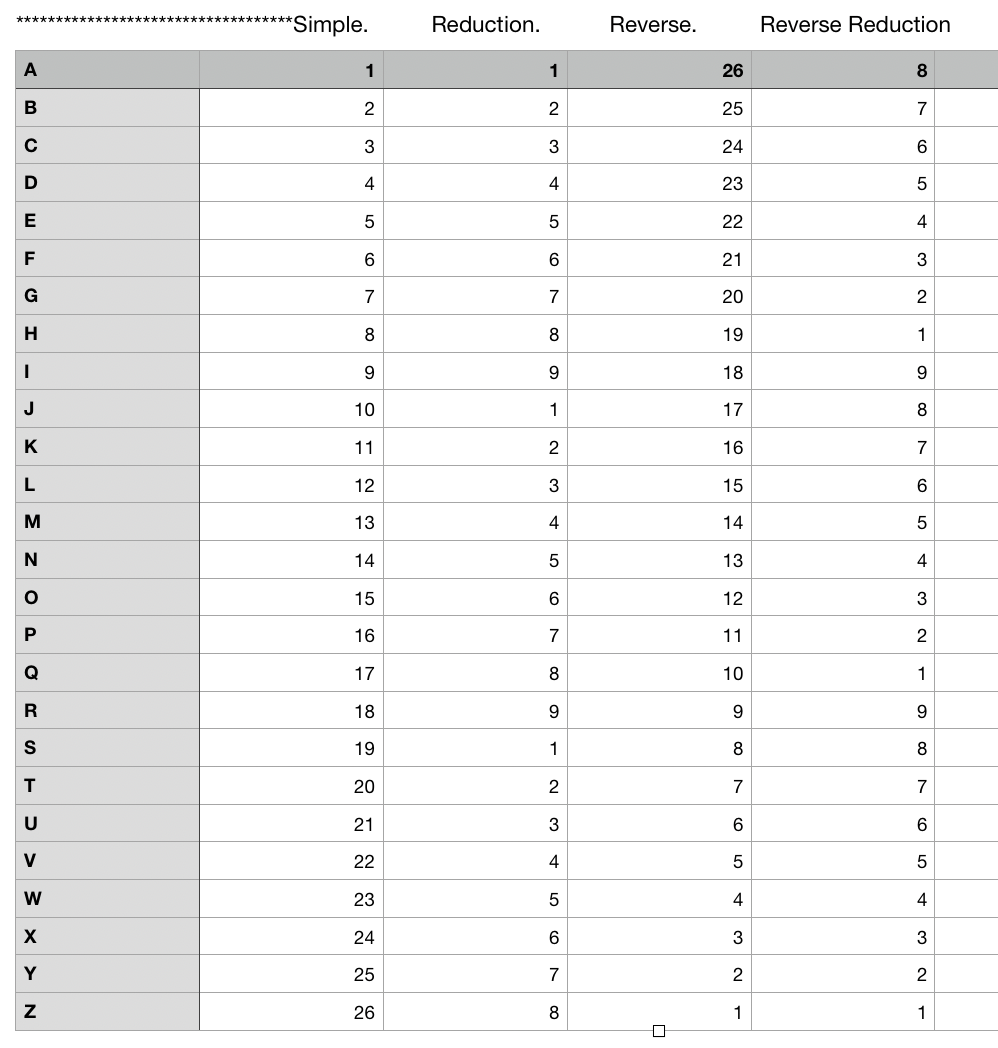

Numbers And The World

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Pdf Prion Diseases Neuromethods 129 Salvador Eduardo Acevedo Monroy Academia Edu

Montana Payroll Calculator Calculate Net Paycheck State And Federal Taxes Estimate Salary In Montana